The Toronto housing situation - the great, big bubble staring everyone in the face (or, at least, all those who aren’t paid to ignore it) is starting to show signs of its age. Predicting the exact moment of it’s potentially explosive demise is a fool’s game. But the symptoms are piling up.

Here are just a few of them that have come to mind recently.

The rich are nervous and frustrated

One of my clients works in the health care space directly with well paid individuals. Mostly doctors. It’s not uncommon for conversations to turn to housing and what my client hears is mostly groans about a lack of affordable options and constantly being outbid in bidding wars.

Banks in Canada are getting nervous

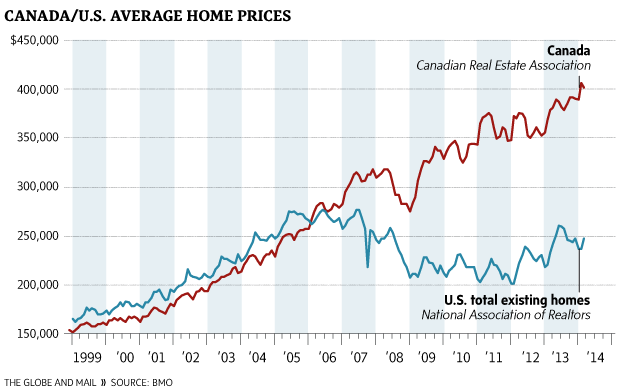

BMO is clearly nervous.

Let’s drop the pretence. The Toronto housing market — and the many cities surrounding it — are in a housing bubble

– BMO Chief Economist Doug Porter

RBC is also clearly getting twitchy

The top executive of Canada’s largest bank says he’s becoming “increasingly concerned” about the impact that high house prices in Toronto and Vancouver could have on the country’s economic growth, and is calling on all three levels of government to work together in devising an intervention.

– Toronto Star, April 6, 2017

The Bank of International Settlements is nervous

In a recent report they basically read Canada the riot act.

“For most countries, debt service ratios stand at manageable levels under the assumption of no change in interest rates (third column). Under more stressed conditions – a 250 basis point increase in rates – and assuming 100% pass-through, the numbers point to potential risks in Canada, China and Turkey” –

Bank of International Settlement</cite>

If you don’t know who the BIS is, you really should look them up. Also, if we’re in the same company as China and Turkey, then we are really in trouble.

Even the Bank of Canada is struggling to choke back admissions of a bubble

The Federal Reserve famously missed or more likely ignored the 2008 meltdown until well past the moment of critical failure. They never admitted the obvious because to do so would have undermined their own credibility. That is, if the Fed lent any support to the idea that the housing situation was even remotely unstable, then the calls to take action - something they would have been loath to do - would have been too loud to dismiss.

Now, the Bank of Canada - sitting right in the middle of the burning house - is struggling not to admit the obvious.

In speaking to Maclean’s, Poloz muddied the Bank’s position further. While house prices are high in Toronto, he said, the underlying fundamentals in recent years might support that. “The greater Toronto economy is creating five per cent per year more jobs,” he said. “Population growth is continuing to be strong. The same thing with Vancouver. That automatically generates more demand for housing at a time when there are constraints around supply.”

Yet at the same time, he pointed to the pace of double-digit house price appreciation and said the fundamentals in the city don’t support such a torrid rate. “The way prices are rising in Vancouver and certainly in Toronto, it would be really hard for me to construct a fundamental story to justify,” Poloz said. “You’re kind of left with [the idea that] some of that must be driven by extrapolated expectations.”

– Macleans Magazine, March 31, 2017

These are the words of a tortured soul trying desperately not to say anything that might force him to take action.

Mainstream media have figured it out.

The Globe and Mail has been on this for a while and recently dialed up the alarm.

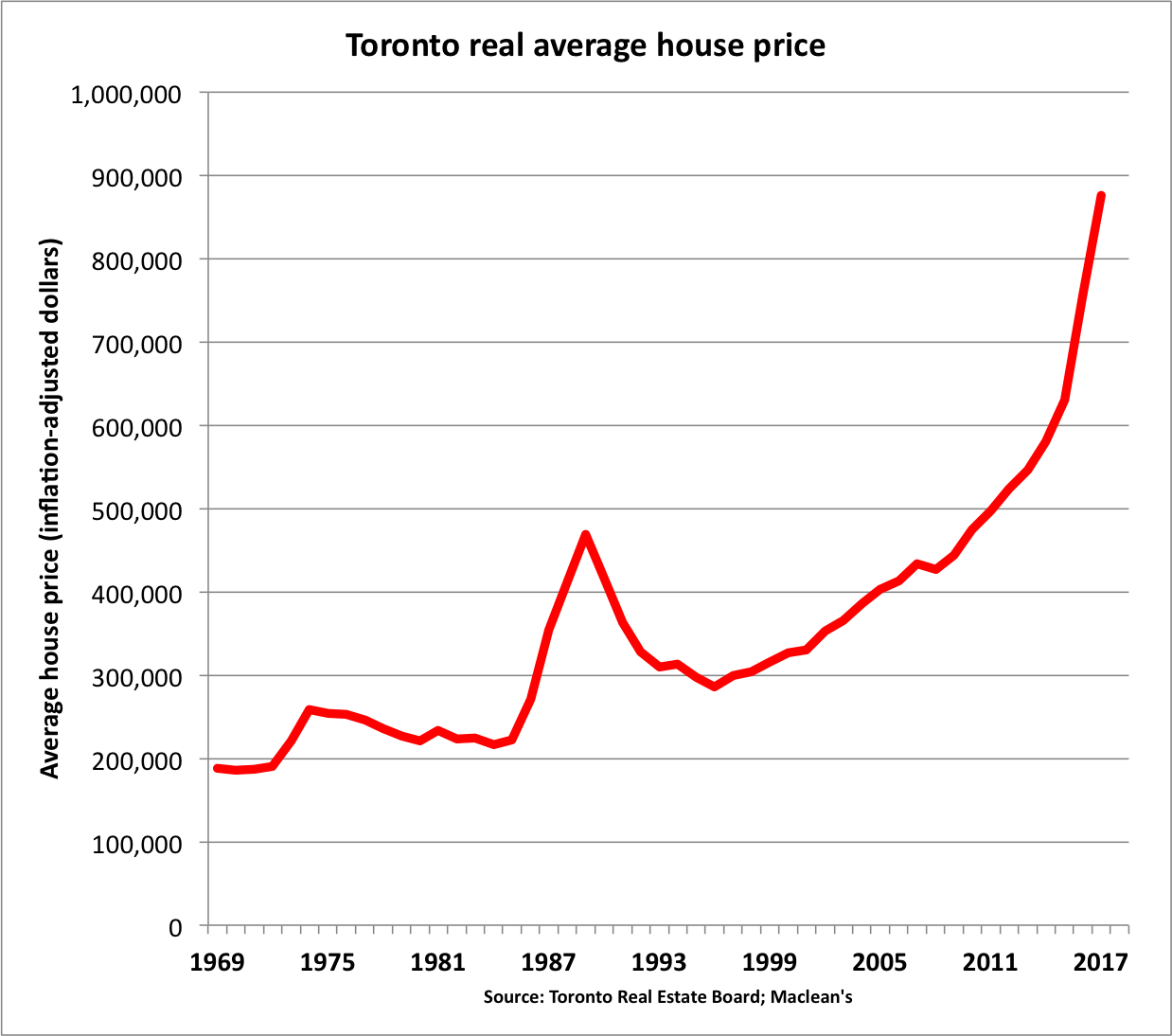

Macleans has been doing a great job for a while now in pointing out the insanity.

Bottom line? Everyone, and I mean everyone, is aware of what is going on. Some are willing to admit it. Some aren’t but likely they never will as not doing so is in their job description.

When you get this level of consensus, you’re well past the stage of formation and into the final stage. Mind you, the final stage is often the one that looks least likely to validate everyone’s concerns as most gains during a bubble are experienced in the final throws when prices go completely vertical.

But when everything looks its absolute brightest is when it’s at it’s absolute worst.